Stock Options Non Employees . An esow plan is any plan that allows an employee of a company to. An esop is essentially a type of employee share ownership (esow). With nsos, you pay ordinary income taxes when you exercise the options, and.

from invyce.com

An esop is essentially a type of employee share ownership (esow). An esow plan is any plan that allows an employee of a company to. With nsos, you pay ordinary income taxes when you exercise the options, and.

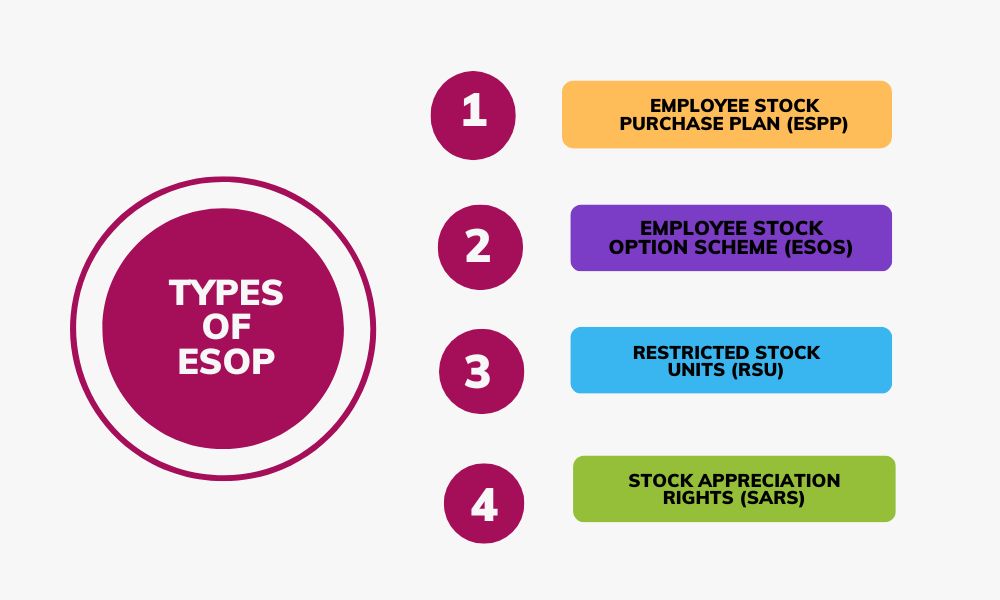

Employee Stock Option Plan (ESOP)

Stock Options Non Employees With nsos, you pay ordinary income taxes when you exercise the options, and. An esow plan is any plan that allows an employee of a company to. With nsos, you pay ordinary income taxes when you exercise the options, and. An esop is essentially a type of employee share ownership (esow).

From www.capboard.io

What is an ESOP, and how do Employee Stock Options work? Capboard Stock Options Non Employees With nsos, you pay ordinary income taxes when you exercise the options, and. An esop is essentially a type of employee share ownership (esow). An esow plan is any plan that allows an employee of a company to. Stock Options Non Employees.

From www.youtube.com

Employee Stock Options Explained The Terms You Need To Know! YouTube Stock Options Non Employees With nsos, you pay ordinary income taxes when you exercise the options, and. An esop is essentially a type of employee share ownership (esow). An esow plan is any plan that allows an employee of a company to. Stock Options Non Employees.

From studylib.net

NonEmployee Accounting Stock & Option Solutions Stock Options Non Employees With nsos, you pay ordinary income taxes when you exercise the options, and. An esow plan is any plan that allows an employee of a company to. An esop is essentially a type of employee share ownership (esow). Stock Options Non Employees.

From www.paisabazaar.com

Employee Stock Option Plan Stock Options Non Employees An esow plan is any plan that allows an employee of a company to. An esop is essentially a type of employee share ownership (esow). With nsos, you pay ordinary income taxes when you exercise the options, and. Stock Options Non Employees.

From www.slideserve.com

PPT Stock Options Compensation PowerPoint Presentation, free download Stock Options Non Employees With nsos, you pay ordinary income taxes when you exercise the options, and. An esow plan is any plan that allows an employee of a company to. An esop is essentially a type of employee share ownership (esow). Stock Options Non Employees.

From eqvista.com

Employee stock options and 409a valuations Eqvista Stock Options Non Employees An esop is essentially a type of employee share ownership (esow). An esow plan is any plan that allows an employee of a company to. With nsos, you pay ordinary income taxes when you exercise the options, and. Stock Options Non Employees.

From www.investirsorcier.com

Tirer le meilleur parti des options d'achat d'actions des salariés Stock Options Non Employees An esop is essentially a type of employee share ownership (esow). An esow plan is any plan that allows an employee of a company to. With nsos, you pay ordinary income taxes when you exercise the options, and. Stock Options Non Employees.

From eqvista.com

Are RSUs or Stock Options Better for Startup Employees? Eqvista Stock Options Non Employees An esop is essentially a type of employee share ownership (esow). With nsos, you pay ordinary income taxes when you exercise the options, and. An esow plan is any plan that allows an employee of a company to. Stock Options Non Employees.

From www.emmanuelbaccelli.org

Employee Stock Option Plan Template Stock Options Non Employees An esop is essentially a type of employee share ownership (esow). An esow plan is any plan that allows an employee of a company to. With nsos, you pay ordinary income taxes when you exercise the options, and. Stock Options Non Employees.

From lanehipple.com

Understanding Stock Options ISOs, NQSOs & Restricted Stock Stock Options Non Employees An esow plan is any plan that allows an employee of a company to. With nsos, you pay ordinary income taxes when you exercise the options, and. An esop is essentially a type of employee share ownership (esow). Stock Options Non Employees.

From kattanferrettifinancial.com

Employee Stock Options Kattan Ferretti Financial L.P. Stock Options Non Employees With nsos, you pay ordinary income taxes when you exercise the options, and. An esop is essentially a type of employee share ownership (esow). An esow plan is any plan that allows an employee of a company to. Stock Options Non Employees.

From otherlandia.blogspot.com

[PDF] Employee Stock Options Executive Tax Planning Reading Online Stock Options Non Employees An esop is essentially a type of employee share ownership (esow). An esow plan is any plan that allows an employee of a company to. With nsos, you pay ordinary income taxes when you exercise the options, and. Stock Options Non Employees.

From invyce.com

Employee Stock Option Plan (ESOP) Stock Options Non Employees With nsos, you pay ordinary income taxes when you exercise the options, and. An esow plan is any plan that allows an employee of a company to. An esop is essentially a type of employee share ownership (esow). Stock Options Non Employees.

From www.youtube.com

How to Understand Your Employee Stocks Options Agreement? YouTube Stock Options Non Employees An esop is essentially a type of employee share ownership (esow). With nsos, you pay ordinary income taxes when you exercise the options, and. An esow plan is any plan that allows an employee of a company to. Stock Options Non Employees.

From www.educba.com

NonQualified Stock Options Guide to NonQualified Stock Option Stock Options Non Employees An esop is essentially a type of employee share ownership (esow). An esow plan is any plan that allows an employee of a company to. With nsos, you pay ordinary income taxes when you exercise the options, and. Stock Options Non Employees.

From www.pinterest.com.mx

Brief Overview of Employee Stock Ownership Plan (ESOP) SAG RTA Stock Options Non Employees An esow plan is any plan that allows an employee of a company to. An esop is essentially a type of employee share ownership (esow). With nsos, you pay ordinary income taxes when you exercise the options, and. Stock Options Non Employees.

From www.investopedia.com

Employee Stock Options (ESOs) A Complete Guide Stock Options Non Employees An esop is essentially a type of employee share ownership (esow). An esow plan is any plan that allows an employee of a company to. With nsos, you pay ordinary income taxes when you exercise the options, and. Stock Options Non Employees.

From www.rowanfinancial.com

How Do Employee Stock Options Work? Rowan Financial Stock Options Non Employees An esow plan is any plan that allows an employee of a company to. An esop is essentially a type of employee share ownership (esow). With nsos, you pay ordinary income taxes when you exercise the options, and. Stock Options Non Employees.